Bond Yield Calculator

Calculate Current Yield & YTM

*YTM is calculated using the approximation formula. Actual yields may vary slightly due to compounding frequency.

Bond Yields: A Comprehensive Guide

Investing in bonds is often viewed as a “safe bet,” but understanding exactly how much you earn from a bond can be tricky.

A bond’s price fluctuates daily, which means the interest rate printed on the certificate (the coupon) is rarely the actual return you will see in your portfolio.

This guide explains how our Bond Yield Calculator works and how to interpret the numbers to make smarter investment decisions.

What is Bond Yield?

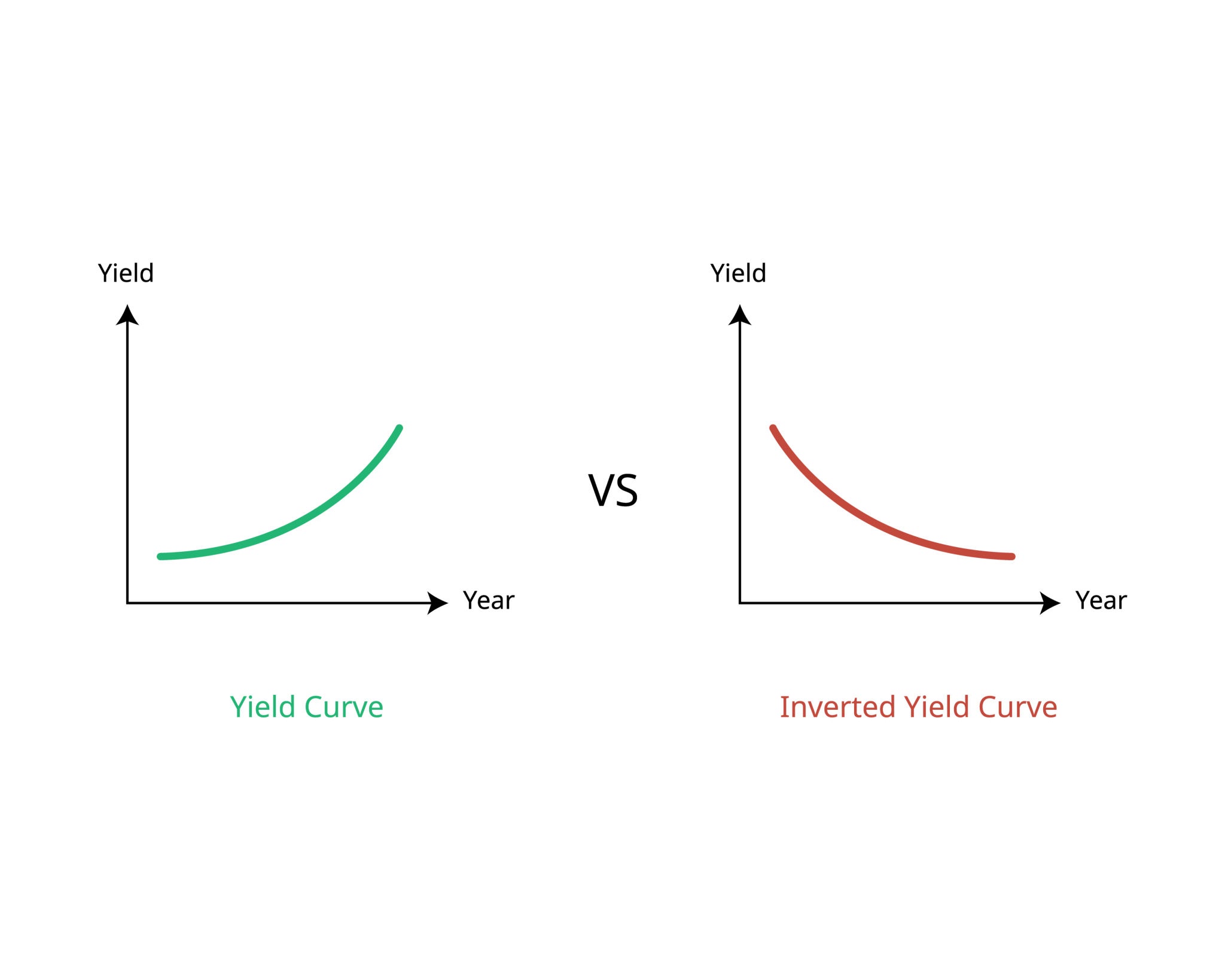

At its simplest, Bond Yield is the return an investor realizes on a bond. While the coupon rate tells you how much interest the bond pays based on its face value, the yield tells you how much you are actually earning based on what you paid for it.

Think of it like buying a rental property:

Imagine a house that generates $1,000 a month in rent.

- If you buy the house for $100,000, that rent represents a high return (yield).

- If you buy the same house for $300,000, the rent is the same, but your return (yield) is much lower because you paid more upfront.

Bonds work the same way. As the price of the bond changes in the market, your effective yield changes.

The Math Behind the Metrics

This calculator computes two critical metrics: Current Yield and Yield to Maturity (YTM).

1. Current Yield

This is a “snapshot” calculation. It looks strictly at the income the bond generates right now relative to its current market price. It does not account for capital gains or losses if you hold the bond until it matures.

Formula:

Current Yield = Annual Coupon Payment / Current Price

2. Yield to Maturity (YTM)

YTM is considered the gold standard of bond metrics. It estimates the total interest rate you will earn if you hold the bond until the day it expires (matures). It accounts for:

- The interest payments you receive.

- The gain or loss you make on the principal (the difference between what you paid and the bond’s face value).

- The time value of money.

Approximate YTM Formula:

YTM = (Annual Interest + ((Face Value - Price) / Years to Maturity)) / ((Face Value + Price) / 2)

How to Use This Calculator

To get an accurate result, you will need the following data points, which can usually be found on your brokerage statement or bond prospectus:

- Face Value (Par): This is the amount the bond will be worth when it matures. For most corporate and government bonds, this is standardly $1,000.

- Current Price: Enter the actual price you are paying (or the current market price).

- Note: If a bond is quoted as “98,” it usually means 98% of par ($980). Please enter the actual dollar amount (e.g., 980).

- Annual Coupon Rate: The percentage interest rate the bond pays annually.

- Years to Maturity: The number of years remaining until the bond is redeemed by the issuer.

Interpreting Your Results

Once you hit calculate, here is how to read the output:

- If YTM > Coupon Rate: The bond is selling at a Discount (Price is lower than Face Value). You earn the interest payments plus a profit when the bond matures at full value.

- If YTM < Coupon Rate: The bond is selling at a Premium (Price is higher than Face Value). You are paying extra upfront to get a higher interest payment, which lowers your overall return.

- If YTM = Coupon Rate: The bond is selling at Par. Your return is exactly equal to the interest rate.

Benchmarks:

- Compare to Risk-Free Rate: Investors often compare a corporate bond’s YTM to the yield of a government Treasury bond of similar maturity. The spread (difference) compensates you for the risk.

- The “Real” Return: Always remember to subtract the current inflation rate from your YTM to understand your real purchasing power increase.

Limitations to Keep in Mind

While this calculator provides a powerful estimation, bond math involves a few theoretical assumptions:

- Reinvestment Assumption: YTM calculations assume that every interest payment you receive is immediately reinvested at that exact same YTM rate. In the real world, interest rates change, and you might not be able to reinvest at the same rate.

- Approximation vs. Iteration: This tool uses the standard approximation formula for YTM. This is accurate enough for general investment decisions, but institutional trading terminals use complex iterative solving to get precision down to the decimal point.

- Default Risk: The math assumes the bond issuer will never run out of money. It does not account for credit risk—the chance that the company might default and fail to pay back the face value.

Related Articles / Calculators