On this page, you will find two types of IRR calculators:

- Fixed cash flow IRR calculator

- Irregular Cash Flow IRR Calculator

Fixed Cash Flow IRR

Use the calculator below to calculate the IRR for recurring payments (like annuities or rentals).

Fixed Cash Flow IRR

Calculate IRR for recurring payments (like annuities or rentals).

Irregular Cash Flow IRR Calculator

Use the calculator below to calculate profitability for investments with uneven or varying annual returns.

Irregular Cash Flow IRR

Calculate profitability for investments with uneven or varying annual returns.

What is the Internal Rate of Return (IRR)?

The Internal Rate of Return (IRR) is one of the most widely used financial metrics for evaluating the profitability of potential investments. In simple terms, it represents the expected annualized growth rate of an investment over time.

Think of IRR as the “break-even” interest rate for a project. If you were to borrow money to fund this investment, the IRR represents the maximum interest rate you could afford to pay on that loan and still break even.

If your actual cost of borrowing (or your required minimum return) is lower than the IRR, the project is generally considered profitable.

How It Works: The Time Value of Money

To understand IRR, you first need to understand the Time Value of Money (TVM).

The core concept is that a dollar available today is worth more than a dollar available in the future because money today can be invested to earn interest.

IRR accounts for this by “discounting” future cash flows back to their present value. It solves for a specific rate that makes the Net Present Value (NPV) of all cash flows (both incoming and outgoing) equal to zero.

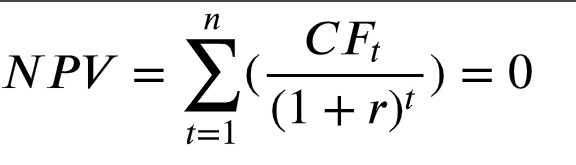

The formula used to calculate this is:

Where:

- CFt = Net cash inflow during the period t

- r = The internal rate of return

- t = The number of time periods

How to Use the IRR Calculator Above

Calculating IRR manually requires complex algebra and trial-and-error (iterative) mathematics. The calculator above uses the Newton-Raphson method to find the precise rate instantly.

- Initial Investment: Enter the total upfront cost of the project (e.g., the purchase price of a machine, the down payment on real estate, or seed capital for a startup).

- Projected Cash Flows: Enter the net profit expected for each individual year.

- Note: If a specific year is expected to have a loss, you can enter a negative number.

- Add Year: If your project lifespan exceeds the default 4 years, click “Add Year” to extend the timeline.

Interpreting Your Results

Once the calculator provides a percentage, how do you know if it is a “good” IRR?

Context is key.

Investors typically compare the IRR to a benchmark known as the Hurdle Rate or Cost of Capital.

- If IRR > Hurdle Rate: The investment is projected to generate returns that exceed the cost of funding it. The project is financially attractive.

- If IRR < Hurdle Rate: The investment may not generate enough return to justify the risk or the cost of tying up capital.

For example, if a company’s cost of capital is 10% and a new project has an IRR of 15%, the project adds value. If the IRR is only 8%, the project destroys value relative to the cost of funds.

Limitations to Consider

While IRR is a powerful tool, it should not be used in isolation. Be aware of these common limitations:

- Scale is Ignored: IRR measures efficiency (percentage return), not magnitude (total dollars). A project with a 50% IRR that returns $100 is often less valuable to a business than a project with a 15% IRR that returns $1,000,000.

- The Reinvestment Assumption: The standard IRR calculation implicitly assumes that all future cash flows can be reinvested at the same high rate as the IRR itself. In reality, finding equally profitable opportunities for that cash might be difficult.

- Irregular Cash Flows: Projects that alternate between positive and negative cash flows multiple times can sometimes mathematically result in multiple valid IRR percentages, which can be misleading.

Always consider using IRR alongside other metrics like Net Present Value (NPV) and Payback Period for a complete financial picture.

Other Financial Calculators / Articles :